Who We Are

WHO WE ARE

We love being a local community bank.

Union Savings Bank has been serving the local area since 1866. And since its inception, our mission has been to work for the benefit of the community rather than for the benefit of shareholders.

As a Connecticut community bank, we live here, work here, and play here. This is our home, and we give back every chance we get, in any way we can.

And in helping to build a better community, we have found it’s helped us to build a better bank; dedicated in purpose and focused in efforts to deliver better products and services for our customers – all while re-investing into the community with grants and service.

Over the last decade alone, Union Savings Bank and the USB Foundation together contributed over $10,000,000 back into our communities, and employees have volunteered thousands of hours to local non-profits.

UNION SAVINGS BANK HISTORY

Dedicated to our community from the very beginning.

Union Savings Bank has been serving the local area since 1866. And since its inception, our mission has been to work for the benefit of the community rather than for the benefit of shareholders.

1866 – UNION SAVINGS BANK IS FOUNDED

Union Savings Bank was founded in 1866 by a group of Danbury’s leading citizens including James S. Taylor, the Bank’s first President. James was a descendant of Thomas Taylor, patriarch of one of the eight original families that founded Danbury. It was their purpose to organize an institution for the encouragement of thrift and the safeguarding of the savings of their friends and neighbors.

JUNE 20, 1866

On June 20, 1866 the Legislature of the State of Connecticut authorized the incorporation of the Bank, which the founders decided should be a mutual savings institution known as the Union Savings Bank of Danbury. The Civil War had recently ended and the name, no doubt, was suggested by the preservation of the union of these United States. And, in fact, time has proven that in Union there is strength. But the word “mutual” is also vitally important in describing the kind of bank our savings bank is. The word “mutual” means we have no stockholders and that Union Savings Bank belongs to its depositors – who share in its net earnings. Another aspect of mutuality is the inherent quality of trust built into our mission.

JULY 23, 1866

Three weeks after the signing of the incorporation papers, the Corporators of the Bank met to establish the Bank officially. It was decided that the Bank should open on July 23, 1866. The bank was first located in trustee Samuel Stebbins’ store on Main Street in Danbury.

MARCH 29, 1887

As the Bank grew, so did the necessity for more space. Well-respected architects Berg & Clark of New York City won a competition to design a new facility at 226 Main Street and it was built in 1886. On Tuesday, March 29, 1887 Union Savings Bank moved into the “United Banks Building.”

1925 – 1927

The impressive 3-story, terracotta brick structure, designed in the Romanesque Victorian style, was originally co-owned and occupied by Union Savings Bank and the National Pahquioque Bank. In 1925, Union Savings Bank expanded and now became the only bank in the building, occupying the entire first floor. The signature Tiffany-style McClintock chime clock was added in 1927. The upstairs once housed the high-school, a 500-seat ballroom, and the YMCA.

1983

Since 1983, the building has been listed on the National Register of Historic Places as part of the Main Street Historic District of Danbury. It still houses our Main Office, and is completely occupied by Union Savings Bank.

2018

In August 2018, Union Savings Bank began the process of reorganizing from a mutual savings bank to a mutual holding company with the goals of making USB stronger, preserving its mutuality and positioning the bank for future growth. In January 2019, after receiving a majority vote from our depositors and regulatory approvals, the reorganization was completed.

The merger was finalized on April 7, 2010. Together, the resulting bank boasts over 340 years of collective banking experience and deep-rooted traditions of helping customers and communities grow and thrive. This transaction is a natural progression which will offer Union Savings Bank customers access to enhanced financial services within a broader geography, while preserving the legacy of community banking in western Connecticut.

The steady growth and stability of the Bank is a tribute to the foresight of the men who founded it. The successful management of Union Savings Bank over the last 150 years, during times of achievement and prosperity as well as depression and disaster, can be credited to all of the Officers who have served since 1866, and to the public-spirited, civic-minded citizens who have served as Trustees and Corporators.

It is because of this strong leadership and commitment by our employees that over the last six years the Bank and the USB Foundation have contributed more than $6 million back into our communities and volunteered thousands of hours to local non-profits. Our unwavering dedication to serve our customers with progressive banking products while making decisions that reflect our knowledge and passion for our local communities differentiate Union Savings Bank.

Our record of safety, together with a reputation for progressive outlook and excellent service to customers make Union Savings Bank the bank of choice in western Connecticut. But Union Savings is a more than a bank. It is a forward-thinking institution of trustworthy, dependable advisors unified by our tradition of helping customers and communities grow and prosper financially; now and for generations to come.

ARCHITECTURAL HISTORY

The Union Savings Bank building.

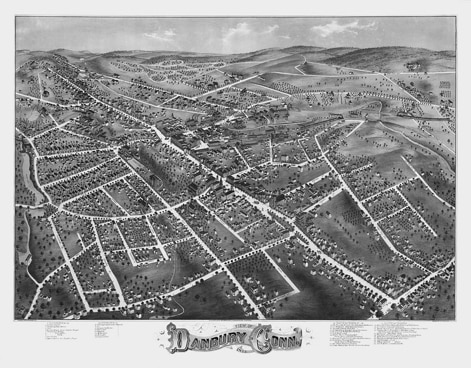

The original Union Savings Bank building was a wood-frame building located at 226 Main Street, Danbury. On a map of Danbury in 1855, the present location of 226 Main Street was occupied by a bank building.

In 1855, the architectural firm of Palliser and Palliser of New York City proposed a two-story building with two banks on the 1st floor, offices on the 2nd floor, and a pitch roof to be used as an attic. The proposal was abandoned.

The firm of Berg & Clark from New York City were the architects of the present building erected on June 29, 1886, a building jointly owned by Union Savings Bank and the National Pahquioque Bank. Meticulously kept records show the contractors who erected the building as follows:

- Contractor – P.E. Reed of Hartford

- Painting – James Crawford of New York City

- Tin roofing – L.D. Manchester of Danbury

- Steam heating apparatus and all plumbing – J. M. Ives Company

- Vault – Hall Safe & Lock Company of Cincinnati (original vault still in use)

Those records also documented the schedule and milestones completed:

- Monday June 29, 1886 – Began digging foundation

- July 27 – Started brick walls

- August 31 – Woodwork begins

- November 24 – Roof and all outside work completed

On Tuesday, March 29, 1887, after the first floor was completed, Union Savings Bank moved into the “United Banks Building” located at 226 Main Street, Danbury. The new building was a three-story brick building (52 x 75 feet) in the Romanesque Victorian style. As reported in the Danbury News Times on February 2, 1887, “One of the latest built and perhaps the most prominent edifice on Main Street is the new bank building occupying the lot adjoining the First Congregational Church to the north.”

Initially the building was co-owned by Union Savings Bank and the National Pahquioque Bank, with Union Savings Bank using half of the first floor via the south corner as entry, and National Pahquioque Bank using the other half with the north corner as entry. Ten independent offices were accessible from Main Street through the central entry to the second floor, and a Men’s Club was located on the third floor.

The Bank building has been renovated three times, with meticulous care taken to preserve and maintain the original architectural details.

In 1925, Union Savings Bank expanded and was now the only bank in the building, occupying the entire first floor. The expansion resulted in revisions to the staircase that accessed upper floors and was relocated to the north entry, and the main entry was relocated to the center of the building. The south entry was replaced by a window. Also added was the prominent Tiffany-style McClintock chime clock, located outside the main entry on Main Street.

In 1970, as a result of a bomb attack and robbery, the vault and area around it needed repair. A one-story addition was built at the back of the building that included a separate entry, the ceiling was lowered with acoustic tiles and fluorescent lights, and a drive-up window was added.

In 2003, renovations included raising the ceiling to maximum height, replacement of the original mechanical systems and replacement of the teller counter (keeping the style of 1925). During this renovation, pieces of frieze and molding from the original lobby were discovered and protected with Christo wrap. The building has been listed on the National Register of Historic Places as part of the Main Street Historic District of Danbury and is considered a historical landmark in the City of Danbury.

MEET OUR EXECUTIVE LEADERSHIP TEAM

This is the kind of experience you should expect in bank management.

The Union Savings Bank Executive Team represents over 150 years of experience in banking and finance. We are dedicated to providing excellent service and financial solutions to our customers and to our community – which are often one in the same.

Chelen is responsible for managing the day-to-day operations of Union Savings Bank, ensuring that all operational aspects of the Bank’s activities are carried out in a safe and sound manner, and in the best interest of USB’s stakeholders, customers, team members, and the community.

Prior to joining USB, Chelen served a number of executive roles at Hudson Valley Credit Union, most recently as Senior Vice President having responsibilities for retail delivery, marketing and lending. In his two decades in banking, he has also held positions in retail banking, lending, wealth management, and marketing with institutions of varying sizes. He has led numerous initiatives focused on strategic growth, new product rollouts, customer relationships, compliance, and training for employees.

Chelen is also heavily involved in community initiatives and has served on the Boards of several non-profits, including Women’s Enterprise Development Center, New Horizons Foundation, Girl Scouts of Suffolk County and Skills Unlimited.

Chelen graduated with a degree in Management from De La Salle University in Metro Manila, Philippines, and holds a Master’s in Business Management from the Asian Institute of Management in Makati, Philippines.

Paul oversees Finance and Treasury activities, directs the management of assets and liabilities, and maintains the investment securities portfolio at USB. He also oversees Bank Operations, Project Planning, IT and General Services. With an over 20-year career in finance, Paul previously served as Chief Financial Officer of Legacy Bancorp, Inc., as a tax senior assistant at Deloitte & Touche, and a tax manager at Ernst & Young. He is a member of the American Institute of Certified Public Accountants, Massachusetts Society of Certified Public Accountants, Institute of Certified Management Accountants Springfield, Mass. chapter and the Institute of Internal Auditors. He currently serves as a board member of the United Way of Coastal and Western Connecticut as well as a member of the Deans Executive Advisory Council for the Ancel School of Business at Western Connecticut State University. Paul received a bachelor of business administration degree in accounting from the University of Notre Dame, a master of science degree in taxation from Bryant University, and a master in business administration degree in finance from Western New England University.

Rick brings over 20 years of experience to his role at USB and oversees Wealth Management, Mortgage and Consumer Lending and the Innovation Center. He joined the Bank in 2006 as the Head of Wealth Management. Prior to joining USB, he was a Senior Vice President and Regional Manager with Webster Financial Advisors in Waterbury. Rick is very active in the community and is the Chairman of the Board of Connecticut Junior Republic which provides services to children and their families throughout Connecticut. Rick obtained his Bachelor of Business Administration degree from Saint Michael’s College, has been designated as a Certified Financial Planner™ (CFP), and received a Certificate of Management Excellence from Harvard University.

Marlene brings more than 30 years of financial experience and leadership to the USB executive team. In her role as executive vice president, she oversees branch banking, business banking, the call center, as well as treasury and merchant services. Marlene earned a Bachelor of Science degree in Business Administration and a Master of Science in Organizational Management from Eastern Connecticut State University. She is very active in the community through her involvement with local businesses, the Greater Danbury Chamber of Commerce, and various nonprofits, including the Cultural Alliance of Western Connecticut. Additionally, Marlene is involved with the Regional YMCA of Western Connecticut and previously served as Chairperson of the Board.

With experience in both the banking and healthcare industries, Jeff’s career in human resources spans almost 40 years. He joined USB in 2015 as Senior Vice President, Director of Human Resources. Since then, he has provided oversight to several departments, including Human Resources, Learning & Development, and Community Relations. Jeff has led numerous initiatives, including creating a more diverse and inclusive environment for employees and customers. He and his team were also instrumental in helping USB navigate through the pandemic. Jeff holds a Bachelor of Science degree from the State University of New York College at Oswego. Currently, he serves on the grants committee of the Union Savings Bank Foundation and serves as the Chairman of the Board for Ann’s Place, a community-based cancer support center.