USB Spending Insights is similar to other spending and budgeting apps that millions of people across the U.S. use, but it’s even better. Why?

Why Is It Better?

- It’s FREE in the USB Mobile App (no other app needed to sign up for or download)

- It automatically integrates with your USB accounts (no set up required)

- Seamless spending categorization

- It’s easy to use the built-in budget and spending trackers

Digital Banking Tutor

Watch our USB Digital Banking Tutor videos to learn how to use features and tools in online and mobile banking.

Spending Insights FAQ’s

What is USB Spending Insights?

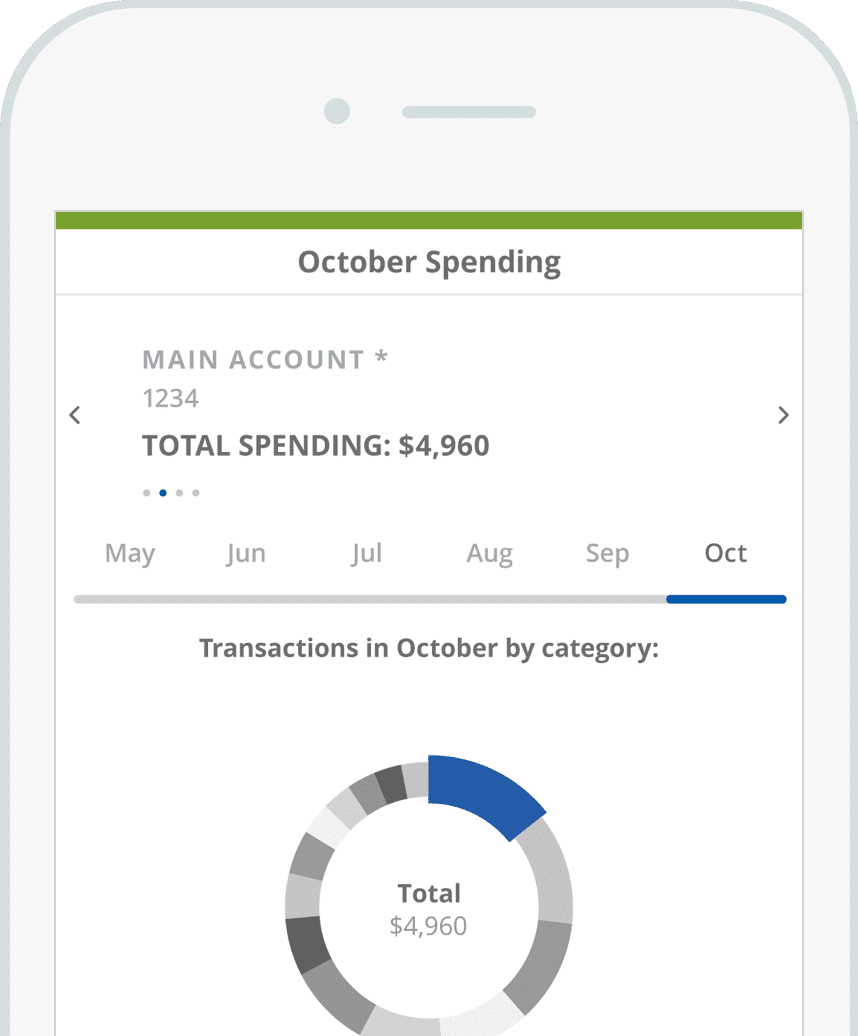

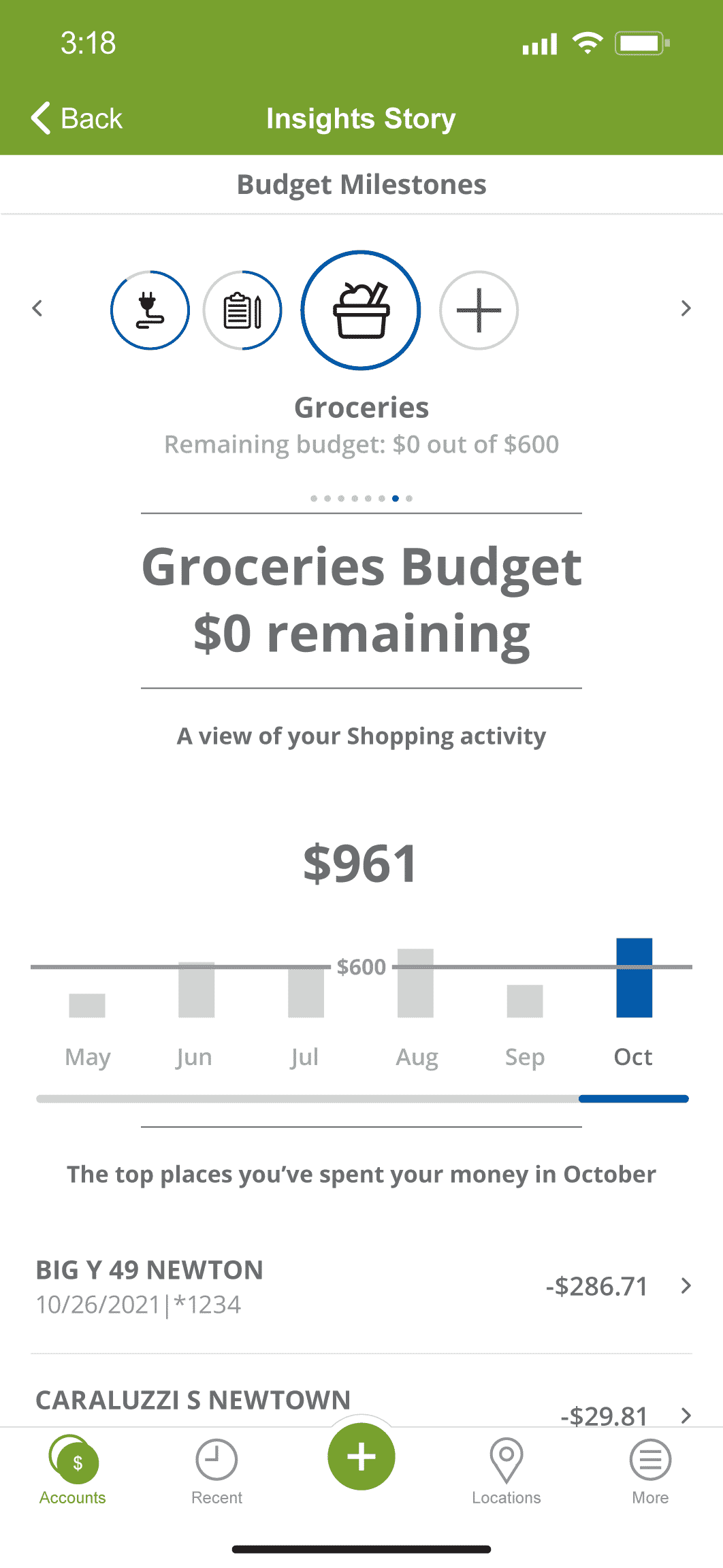

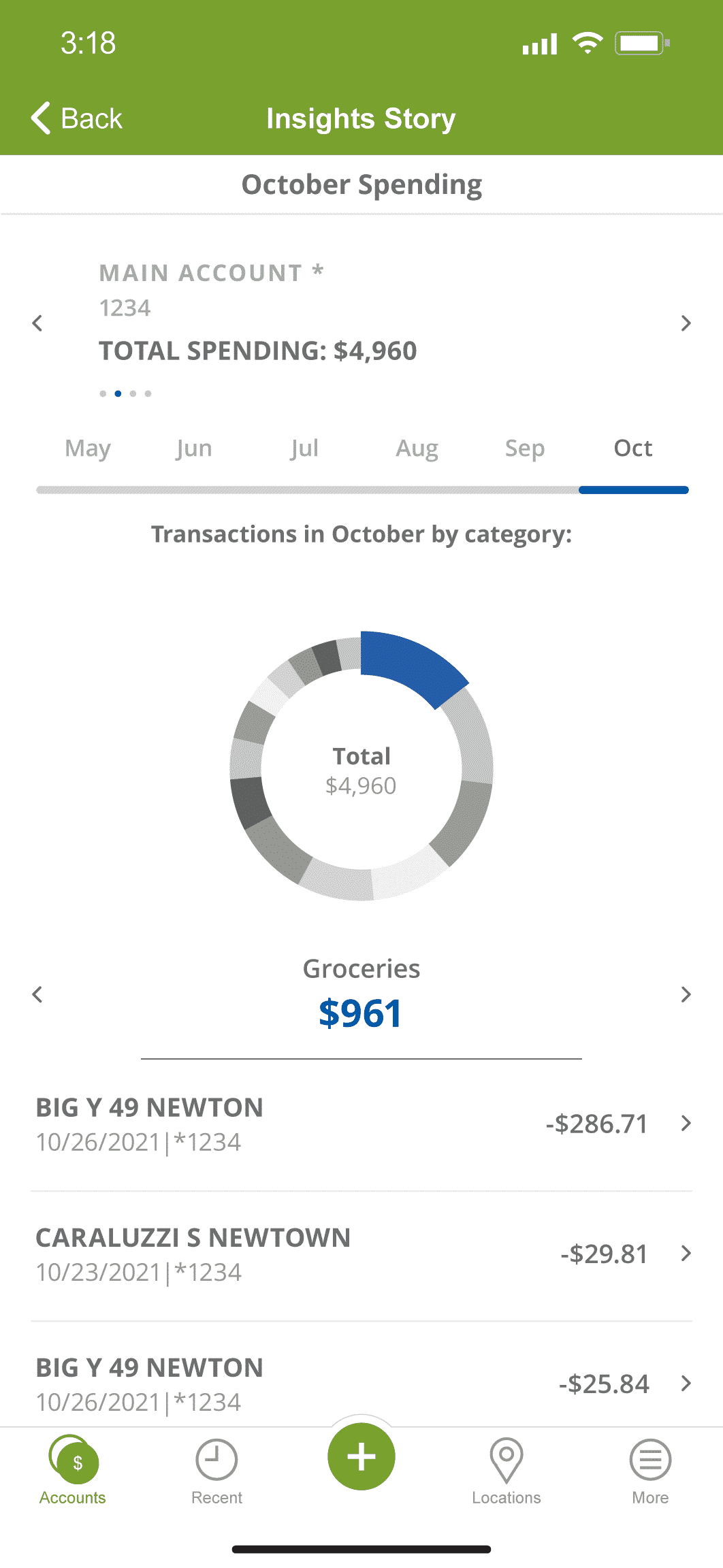

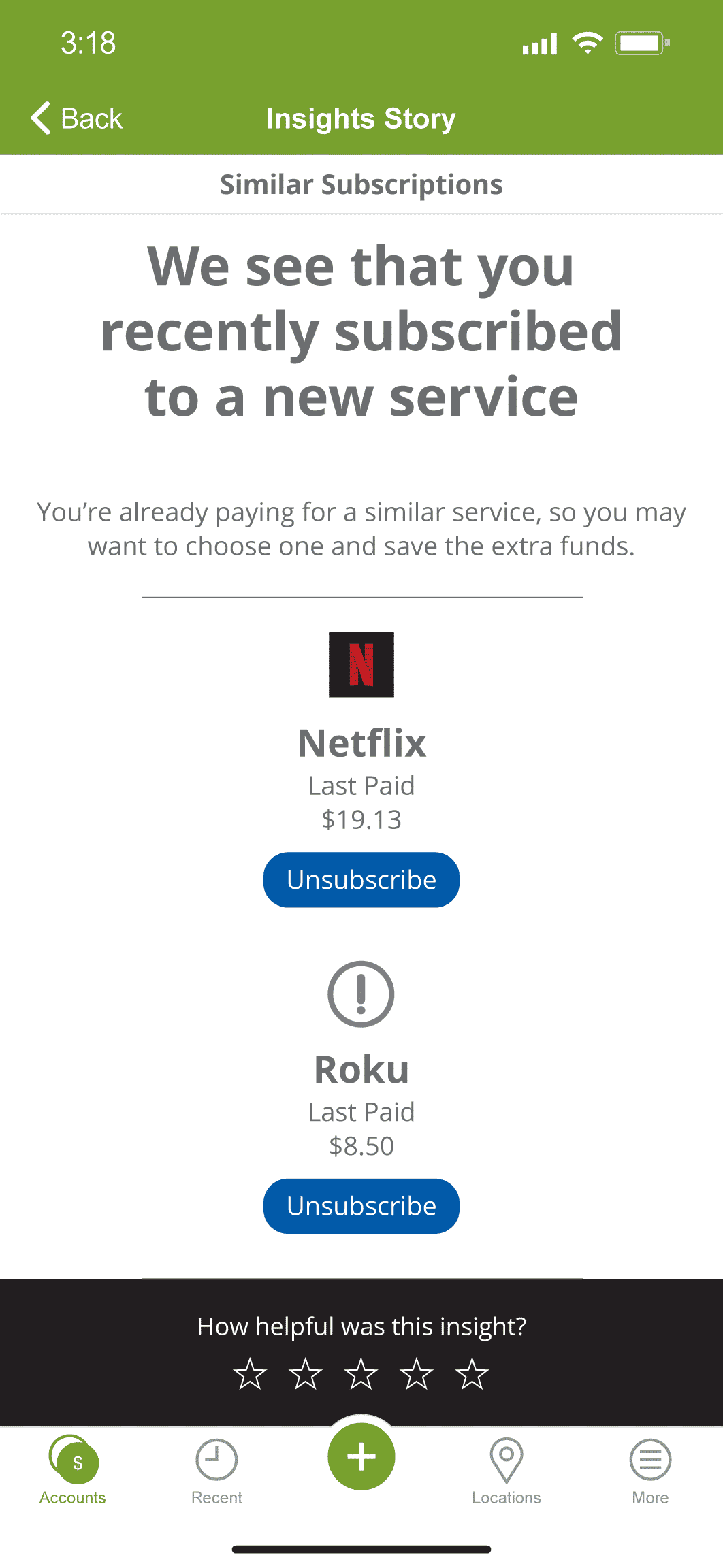

Spending Insights monitors your accounts, predicts how much money you’ll have based upon your historical patterns, and suggests actions you can take. Spending Insights can be found below your Accounts in the USB Mobile App.

How does USB Spending Insights work?

Spending Insights utilizes Artificial Intelligence to monitor the historical spending patterns of your Deposit accounts and contactless Debit Card usage to display observations and alert you to potential shortfalls and opportunities to save based upon your current, historical and predicted banking activity.

Why/How should I use USB Spending Insights?

Spending Insights will help you stay on top of your finances by monitoring historical spending patterns of your Deposit accounts and contactless Debit Card usage. This feature will display observations that will help you set budgets in various spending categories and keep you appraised of your progress. It will also help alert you about possible balance issues and update you on when important deposits are received, like direct deposits from payroll or government payments.

Are USB Spending Insights secure?

Yes, Spending Insights are only accessible by you and any joint account holders who have Mobile access to your accounts. We use the latest security software and procedures to protect your information. Spending Insights and data are not shared with outside merchants or unauthorized third parties.