Commercial Loans for Manufacturers

Whether it’s finding new factory space or purchasing new equipment, we’re here to help keep your business moving.

Why Work With the USB Commercial Team?

- Extensive experience working with various manufacturing industries based in Connecticut

- Understand cyclical working capital needs around raw materials, production, and payment terms

- Specialized lending programs tailored to manufacturing

- Structure loans that match cash flow patterns unique to manufacturing (e.g., progress payments, seasonal demand)

- A true partner for your business needs

- Competitive rates

Solutions for Manufacturers

Business Growth Starts Here

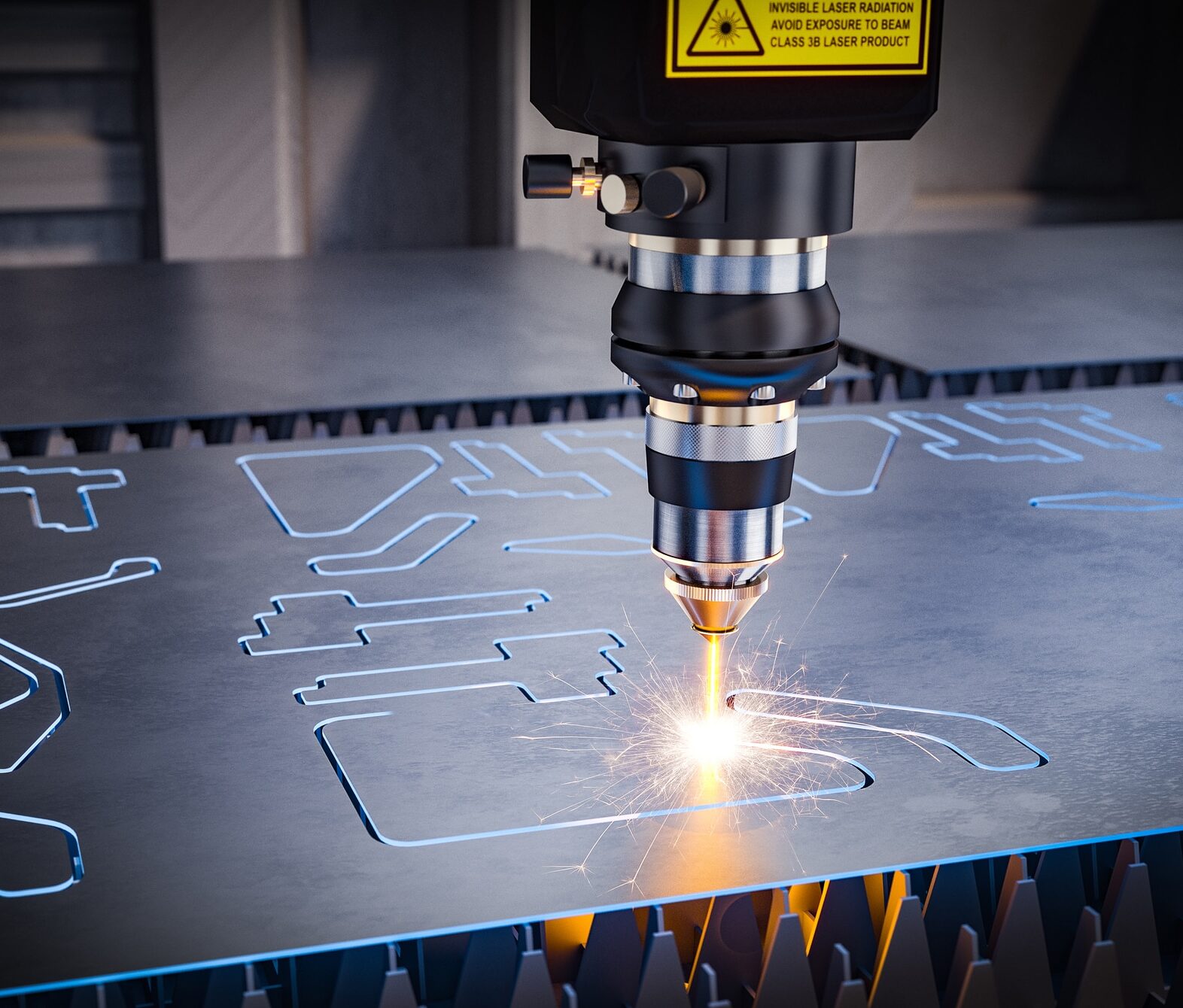

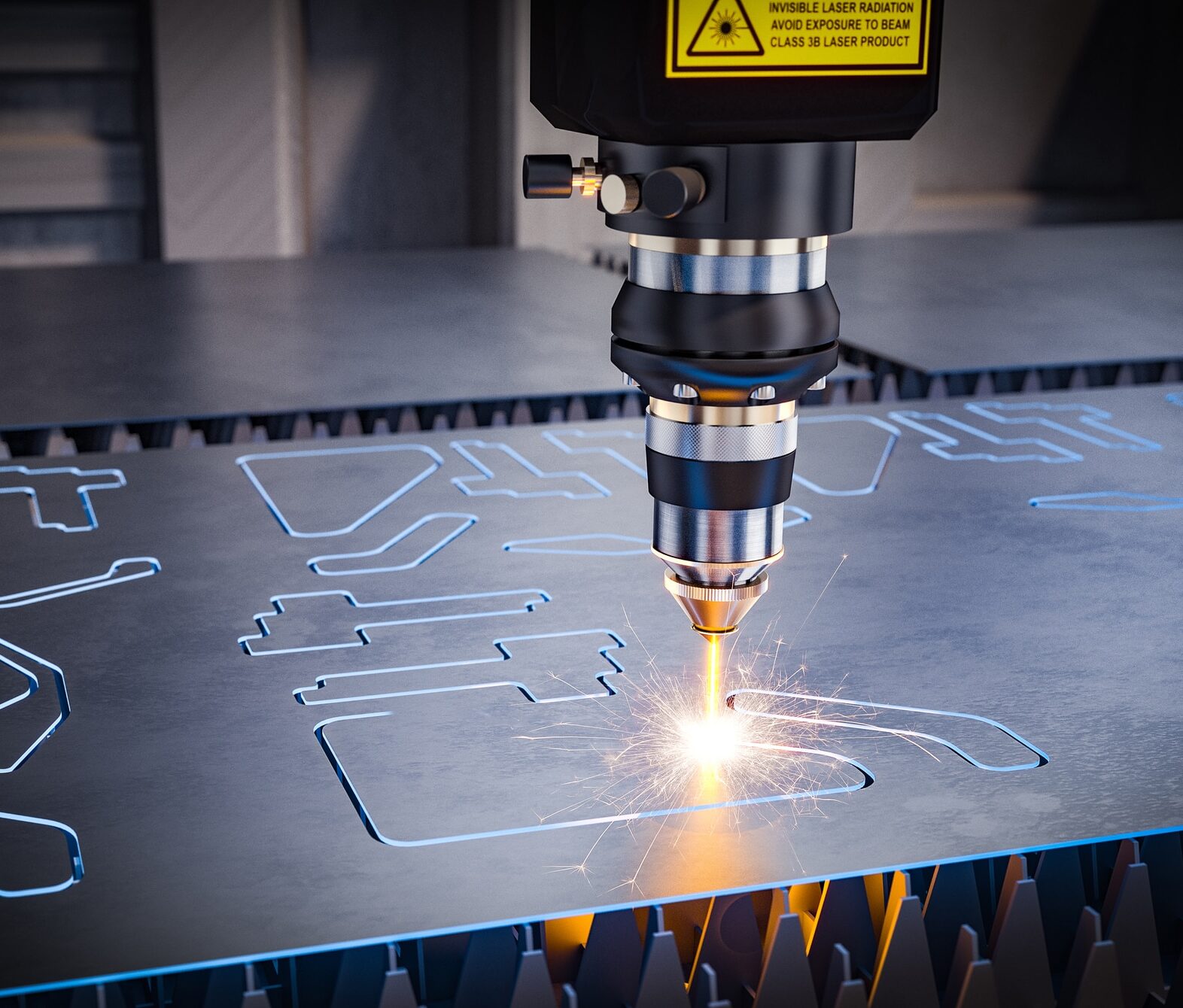

- $100,000Equipment Term Loan

Metal Manufacturer

Winsted, CT - $6,000,000Line of Credit

Plastic Fabrication Manufacturer

Danbury, CT - $285,000Term Loan

Manufacturer

Bridgeport, CT - $5,000,000Line of Credit

Consumer Products Manufacturer

Watertown, CT - $60,000Term Loan

Manufacturer

Bridgeport, CT - $2,400,000Construction/Permanent Mortgage

Industrial building

Oxford, CT

Customer Stories

There aren’t many businesses that can say they are in their fifth generation. For John Koster, president of Koster Keunen Manufacturing, located in Watertown, CT, there is a sense of responsibility to make it to the sixth and seventh generations. John’s over 14-year business banking relationship with Union Savings Bank has grown as the business has grown, to where the U.S. location now occupies over 100,000 square feet. A revolving line of credit helps finance the company’s seasonal purchases so Koster Keunen can deliver materials year round. Providing for customers as their needs arise – it’s a goal we have in common.

COMMERCIAL BLOG

Boosting Manufacturing Production: How to Secure Funding for Expanding Facilities

As the industry evolves and competition becomes more intense, manufacturers need to stay agile and adaptable. Learn how financing options can help.

Disclaimers

All loans and lines are subject to credit approval.