- ACCESS CHECKING

- ESSENTIAL CHECKING

- CORE CHECKING

Not sure where to begin?

Let's compare accounts.

- ACCESS CHECKING

- ESSENTIAL CHECKING

- CORE CHECKING

- Minimum Opening Balance

- $50

- $25

- $10

- Service Fee Per Statement Cycle

- $201

- $5

- Earns Interest On Your Balance

- eStatements

- 2

- 2

- Online Banking with Bill Pay

- USB Mobile App

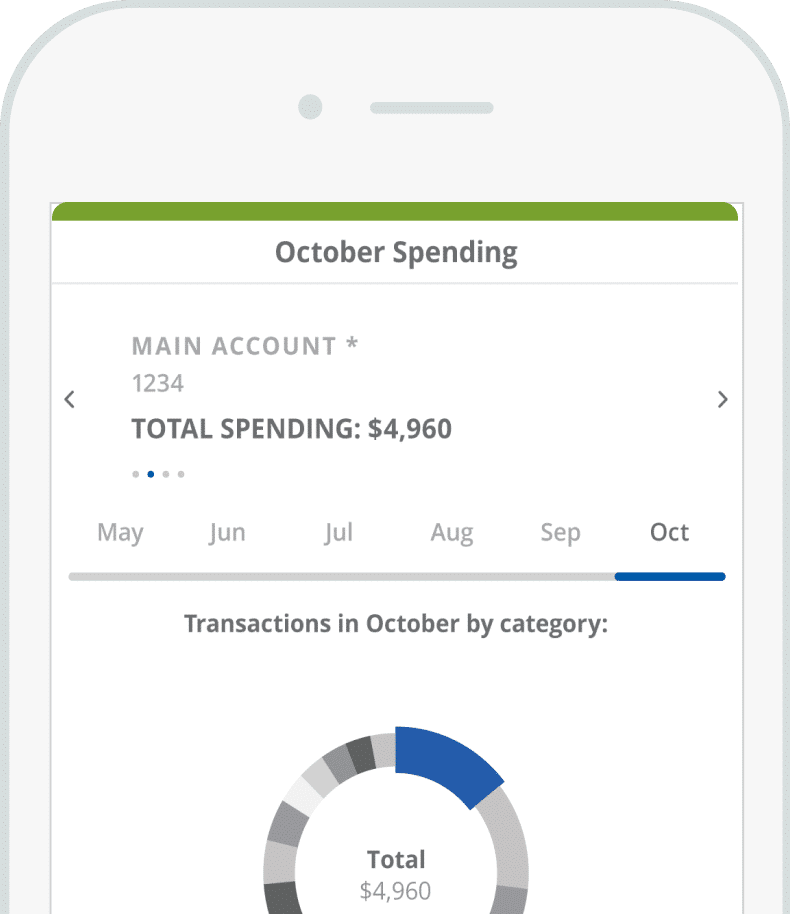

- USB Spending Insights in the Mobile App

- Early Payday

- ATM Transaction Charges

- USB ATMs

- No charge

- No charge

- No Charge

- Non-USB ATMs

- Unlimited

- USB fee waived up to 6 times per statement cycle for ages 15-24³

- $2 per transaction

- $0 monthly service fee Access Savings account

- 4

- $0 monthly service fee Essential Savings account

- 5

- 5

- Contactless USB Debit Card

- 6

- 6

- 6

- Check writing and withdrawals per month

- Unlimited

- Unlimited

- Unlimited

- FDIC Insurance

- 7

- 7

- 7

- Overdraft Protection

- 8

- 8

- Direct Deposit

- Apple Pay

- Google Wallet

- Samsung Wallet

- USB Visa Credit Cards

- 9

- 9

- 9

Checking Account Rates

- Annual Percentage Yield (APY)**

- $0.01 - $4,999.99

- 0.03%

- $5,000.00 - $24,999.99

- 0.03%

- $25,000.00 - $49,999.99

- 0.04%

- $50,000.00 - $99,999.99

- 0.06%

- $100,000.00+

- 0.08%

- Interest Rate

- $0.01 - $4,999.99

- 0.03%

- $5,000.00 - $24,999.99

- 0.03%

- $25,000.00 - $49,999.99

- 0.04%

- $50,000.00 - $99,999.99

- 0.06%

- $100,000.00+

- 0.08%

- Frequency of Rate Change***

- Variable

- Interest Compounding

- Monthly

- Interest Credited

- Monthly

- Minimum Balance to Open Account

- $50.00

- Minimum Balance to Earn APY

- $0.01

Disclaimers

Account becomes overdrawn, fees may be assessed. Please see our Schedule of Interest and Deposit Account Charges or call 866.872.1866 for further information.

1 There are 3 ways to waive the monthly service fee: maintain a minimum balance of $5,000, combined deposit balances of $25,000, or combined deposit and loan balances of $50,000. Loan balances include consumer and mortgage loans.

2 There is no charge for eStatements. Paper statement fee is waived for primary owner 60 years or older. Paper Statement fee is $3 for Essential Checking and $2 for Core Checking.

3 $2 Non-USB ATM transaction fee waived up to 6 times per statement cycle for ages 15-24 (age based on primary owner).

4 No $5 monthly service fee when primary owner of Access Savings account is an owner of Access Checking account.

5 No $3 monthly service fee when primary owner of Essential Savings account is an owner of Essential Checking or Core Checking account; account subject to $3 monthly paper statement fee if primary owner is under 60 years of age.

6 Card will be issued to a minor for joint accounts only (accounts titled jointly with an adult parent or guardian).

7 Deposits are insured up to FDIC limits. Click here for FDIC calculator.

8 Overdraft protection options include automated savings transfers and Overdraft Protection Line of Credit. Subject to credit approval. Customers must be 18 years or older or have an adult listed on the account to apply for an Overdraft Protection Line of Credit. This does not apply to Health Savings or Core Checking accounts as overdrafts are prohibited. Visit www.unionsavings.com or call 866.872.1866 for further information.

9 The creditor and issuer of these Cards is Elan Financial Services. Separate credit application and credit approval required.

Separate enrollment in Digital Wallets is required.

Apple Pay is a trademark of Apple Inc. Google Wallet is a registered trademark of Google Inc. Samsung Wallet is a registered trademark of SAMSUNG. All Rights Reserved.

*Fees may reduce earnings

**Rates may change after the account is opened